Dhata Tech and MatchMove have partnered together to provide customers with Banking as a Service to clients wanting to extend financial services to its consumers.

Using MatchMove's product solutions, any company can provide their end-users the ability to top-up and withdraw cash in real-time, spend via their prepaid virtual and physical cards as well as perform instant domestic money transfers as well as cheaper international remittances. This is made possible via secure virtual accounts which can be linked to a customer's bank account for instant wallet top-ups and withdrawals while leveraging MatchMove's RESTful APIs for convenience.

MatchMove solutions include the full suite of services to move money locally and globally in a safe and compliant manner. It offers fully managed services and developer-friendly features that connect consumers, merchants and financial institutions, enabling their clients.

We use best-in-class security tools, technology, and banking industry practices to maintain the highest levels of security.

Our services are fully compliant and licensed to operate within national and international regulations.

Works better than cash and can be paired with virtual or physical cards

Customer buys from your app, website, or store

You issue a virtual account instantly

You deposit rewards, rebates, and refunds

Customer uses those rewards, rebates, and refunds for repeat purchases

Customer buys from your app, website, or store

You issue a virtual account instantly

You deposit rewards, rebates, and refunds

Customer uses those rewards, rebates, and refunds for repeat purchases

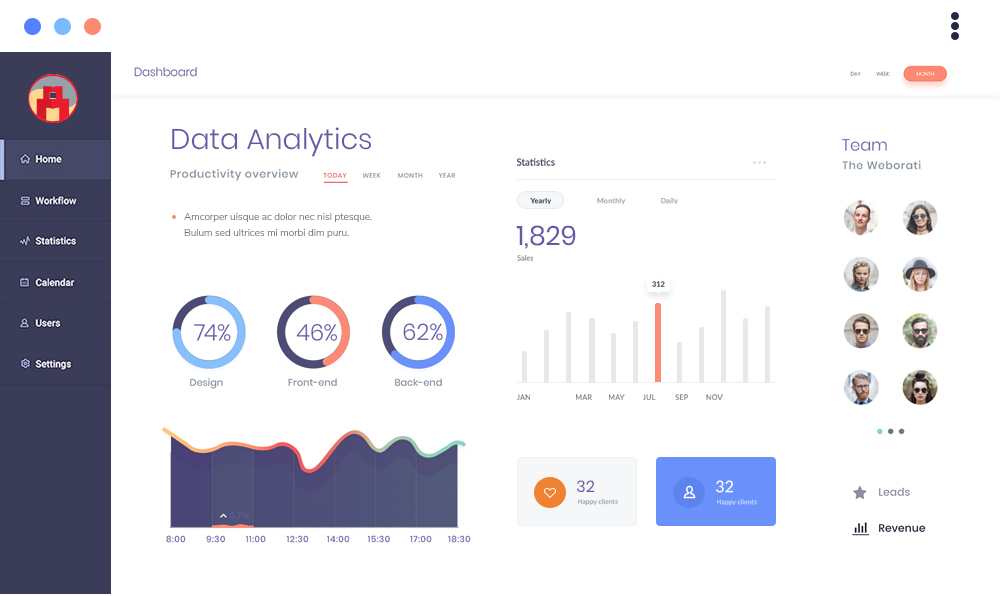

Deliver real-time digital cash transfers to virtual accounts, digital wallets, and traditional bank accounts

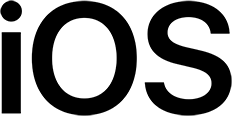

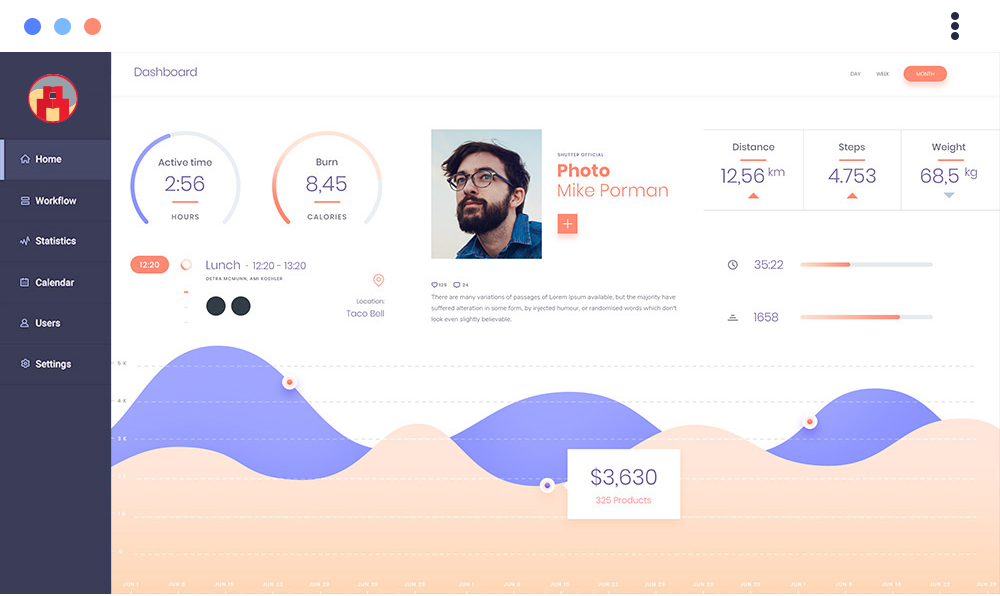

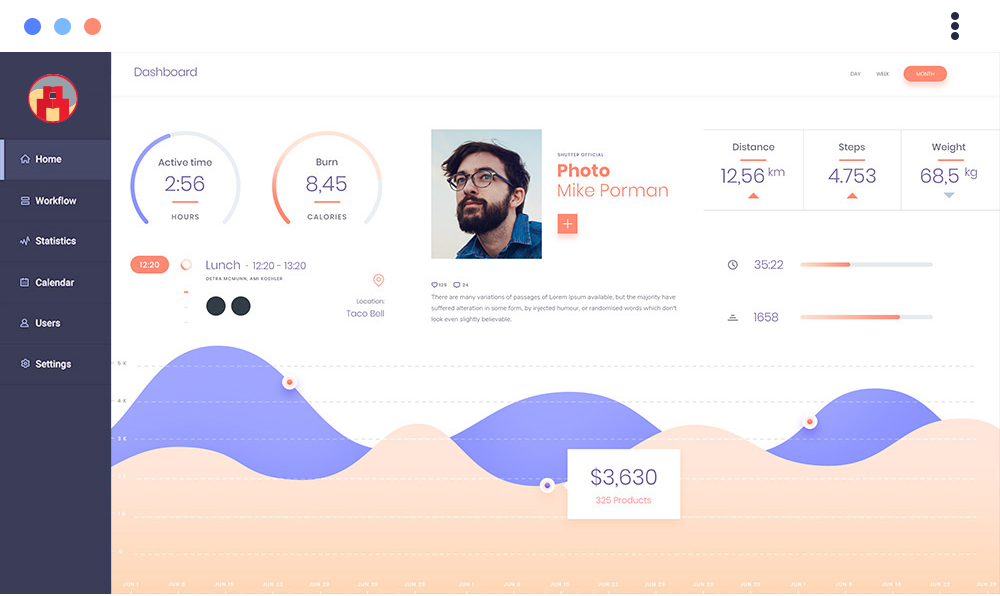

Digitize and automate your users' banking needs with your own next-generation bank-grade wallet plus card. Offer consumers and employees a better, more seamless experience than with traditional banks.

Businesses and FinTechs including neo-banks use MatchMove to scale their business by providing their customers a faster, safer, and easier way to move cash.

Digital wallets and open loop cards provide a more frictionless payment solution.

Real-time analytics of customers' spend and send patterns enables companies to offer more personalized services.

Monetize your customer base in new ways — every time your customers spend, send or lend, you can make money on every transaction.